AMP Deputy Chief Economist Diana Mousina looks at the inflation outlook.

Inflation across most major economies has been slowing noticeably over recent months. While it may seem like the fight against inflation has been won by central banks, some recent indicators have ticked up again which could see inflation take financial markets by surprise and start rising again in late 2023/early 2024.

Here are four indicators that could put pressure on inflation.

1. Price surveys

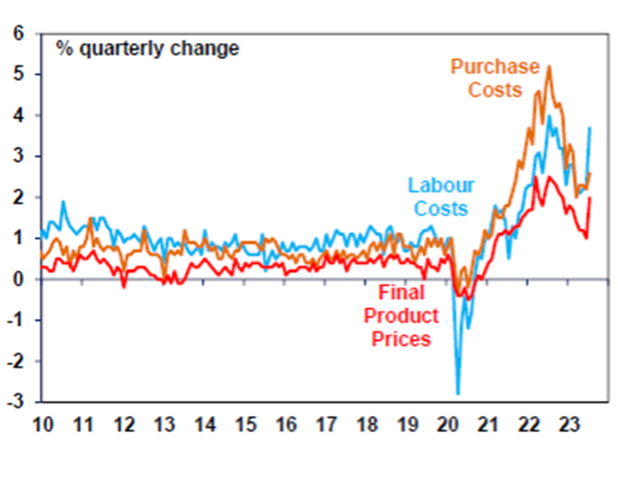

Purchasing Managers’ Indices (PMIs) are a good leading indicator of global activity. After declining since mid-2022, input and output costs have stabilised in recent months and some look to be picking up again.

As you can see in the chart below, Australian price indicators have also been trending up, especially in July, although this could be a one-off spike because of the decision to lift the minimum wage in June.

NAB Survey: Price Indicators

Source: Bloomberg, AMP

The trends in these price surveys are worth watching, as they tend to lead the hard inflation data.

2. Weather events and commodity prices

Extreme weather events can disrupt food production and supply leading to volatility in food prices. While central banks usually look through spikes in prices, the events of the past few years have shown that temporary price changes can seep into numerous components of the supply chain. After large increases in food prices throughout 2021-22, food inflation is expected to slow further – see the chart below.

Global Food Prices and Consumer Inflation

Source: Macrobond, AMP

There’s a risk that El Niño weather patterns will lead to higher Australian agricultural prices over the next 3-6 months. Outside Australia, El Niño also tends to be inflationary as non-fuel commodity prices rise, fuel prices increase (coal and crude oil demand rises as there’s lower output from hydroelectric power plants) and governments may decide to restrict supply of agricultural commodities.

Beside these weather disruptions, many commodity prices have been increasing lately including gas, coal and oil, which will add to higher near-term inflation.

3. Inflation expectations

US short-term inflation expectations have come down from their 2022 highs and medium-term expectations are still well contained but have drifted higher over the past months and are around 3% – the top end of central bank’s target range. Inflation expectations need to remain anchored to keep actual inflation contained.

US University of Michigan Consumer Inflation Expectations

Source: Macrobond, AMP

4. Real wages and consumer confidence

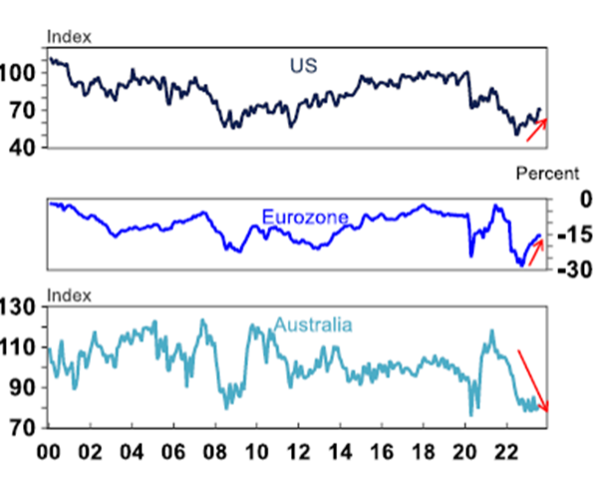

The slowing in headline inflation has led to a rise in real wages growth (the difference between nominal wages and inflation) around the world, although it’s still negative in Australia and the Eurozone. A rise in real wages could see consumers increase spending and lead to a rise in inflation again.

The increase in real wages growth appears to have led to a rise in consumer confidence (see the chart below) in the US and Eurozone. Australian consumer confidence is still around record lows.

Global Consumer Confidence

Source: Macrobond, AMP

What this means for investors

The rate of inflation could start increasing again leading to renewed concern about further rate hikes, higher bond yields and the risk of a recession which would be negative for share markets.

While this is a risk, we still see inflation headed lower through 2023 and into 2024 due to restrictive interest rates. But it’s worth watching the leading inflation indicators for signs of movement.

In the longer term, inflation is likely to remain higher than pre-COVID levels due to:

- the reversal of globalisation towards onshoring

- bigger governments and more intervention in sectors

- an increase in government defence spending leading to bigger budgets

- a decrease in the working age population

- the impact of climate change.

There may be some offset from productivity improvements related to technology (and more specifically artificial intelligence) which could help to keep inflation down.

This article has been written by Diana Mousina, Deputy Chief Economist at AMP.

Current as at October 2023

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.